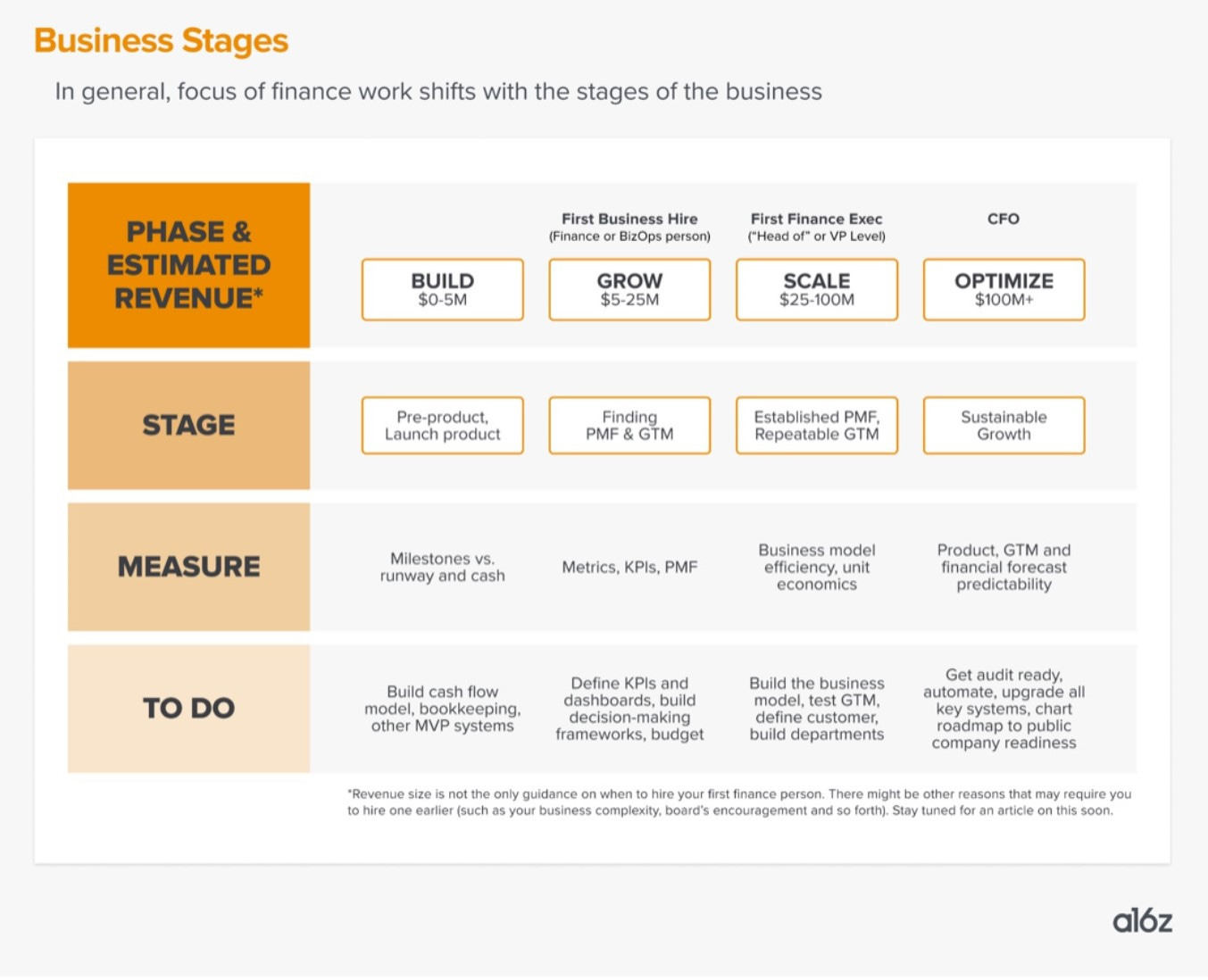

“In what order should I hire my finance team?”

This is a question I get from business leaders across all stages.

Here’s the blueprint for hiring (and scaling) your finance team.

-

Outsourced accounting firm for book keeping, payroll, and tax filing

The rise of specialized SMB fintech tools and platforms (e.g., Mercury, Gusto, QuickBooks Online) have made it easier for early-stage startups to manage finances without in-house staff.

I once heard of a company (OK, it was FitBit) who used QuickBooks through $300m in revenue. That’s gotta be a world record!

Anecdotally, I’ve heard of tech companies relying on fractional support through $25M in ARR. That’s certainly the top end, but it shows that you can rely upon fractional support for longer, allowing the company more headroom to make critical hires within G&A for HR and Recruiting.

-

First business hire

The days have changed where you bring a heavy handed accounting hire in-house first. Accounting can remain a flex resource if you find the right firm.

The world has shifted priorities from traditional finance roles to more strategic, data-driven positions that can support rapid scaling and fundraising efforts, and bridge the gap between finance and ops.

This person should come from a finance, biz ops, or investment banking background. They’ll need to be great at financial modeling and can help the founder incorporate data into decisions. They’ll also be instrumental in helping to raise the Series A or B round.

A quote from a VC friend below:

“I’m actually seeing virtually no market for controllers right now. We have zero open req’s across [#] portco’s and recruiters are telling me the same. So the model where controller is the first to arrive has largely been changed and maybe permanently with the emergence of good small bookkeeping firms and products in the space that de prioritizes accounting.”

Don’t get me wrong – I love me some accounting. In fact, I show a heavy investment at later stages. It’s just the timing that matters if you want to get your finance function humming on all cylinders.

-

Head of Finance

-

Accounting Manager

-

Payroll manager (or Junior Accountant)

-

FP&A Manager to build the first formal annual budget (needed for Series C raise)

-

Sales Operations Analyst for quota deployment and deal execution

The Head of Finance is probably equivalent to a Director level at most later stage companies, with a hunger to move up the ranks, build something, and push the pace. There’s potential for this spot to get filled by the “first business hire” we previously touched on. To succeed, they ideally have some sort of FP&A background to mature the short term and long term operating model.

After picking a Head of Finance, their first job is typically to usually hire an Accounting Manager. That role will be their closest business partner in the early days, establishing a rhythm of how cash enters and leaves the building.

The full blown “Controller” role is being hired less and less early on. Instead firms are waiting until later (as we address below) to hire a VP of Accounting.

If the Head of Finance comes from an FP&A background, they can usually be a player coach for a while, building out the operating plan and doing the variance analysis themselves. But eventually they’ll want the support of an FP&A Manager to help them scale the budgeting process and ensure department heads have enough ad hoc support.

I should also mention that the Head of Finance’s role involves not just hiring but also setting up the right financial infrastructure, including choosing the right financial software stack that can grow with the company. This is usually around the time the systems start to become more numerous and complex. Speaking of that…