I’ve done many financial statement breakdowns in my career. I’ve gone DEEP into the 10K’s and S-1’s from some of the top tech companies. But perhaps it was all in preparation for the most fascinating analysis of my career—a private company out of the UK called OnlyFans.

Below is a deep dive into the financials and business model of a social media behemoth. And not to bury the lead here – but sex sells – to the tune of over $1 billion dollars in revenue per year.

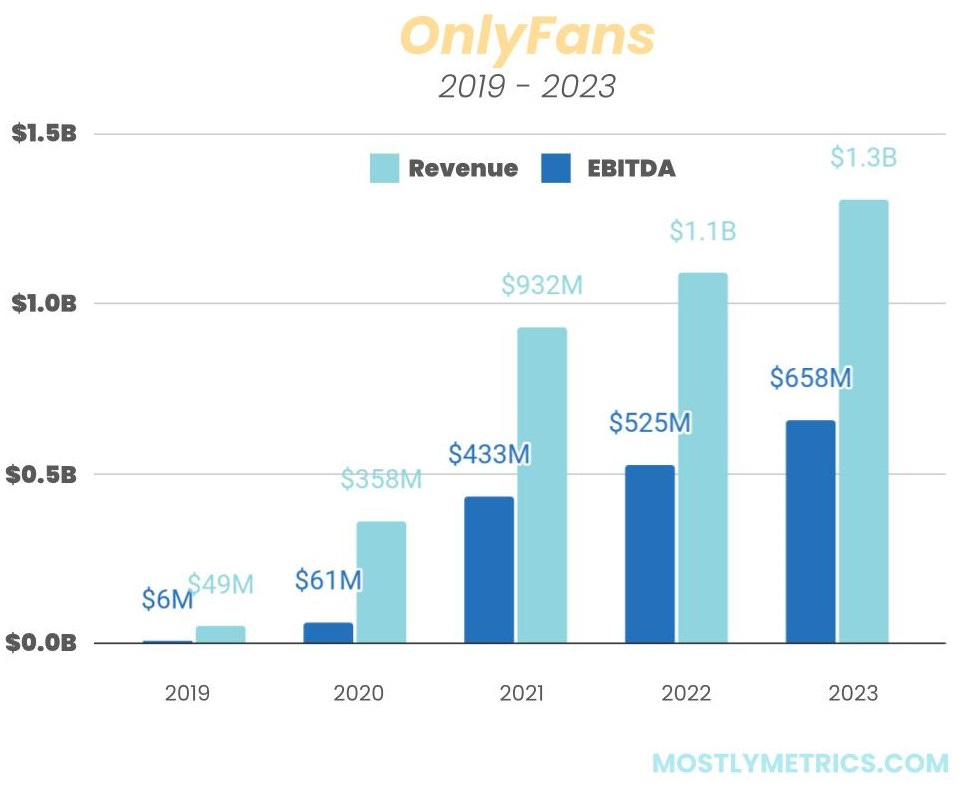

OnlyFans had a record-breaking year in 2023, eclipsing $1.3 billion in revenue—a 20% year-over-year increase—and generating an eye-watering $658 million in profit before tax, which was up 25% from the previous year.

They did this with fewer than 50 employees 🤯.

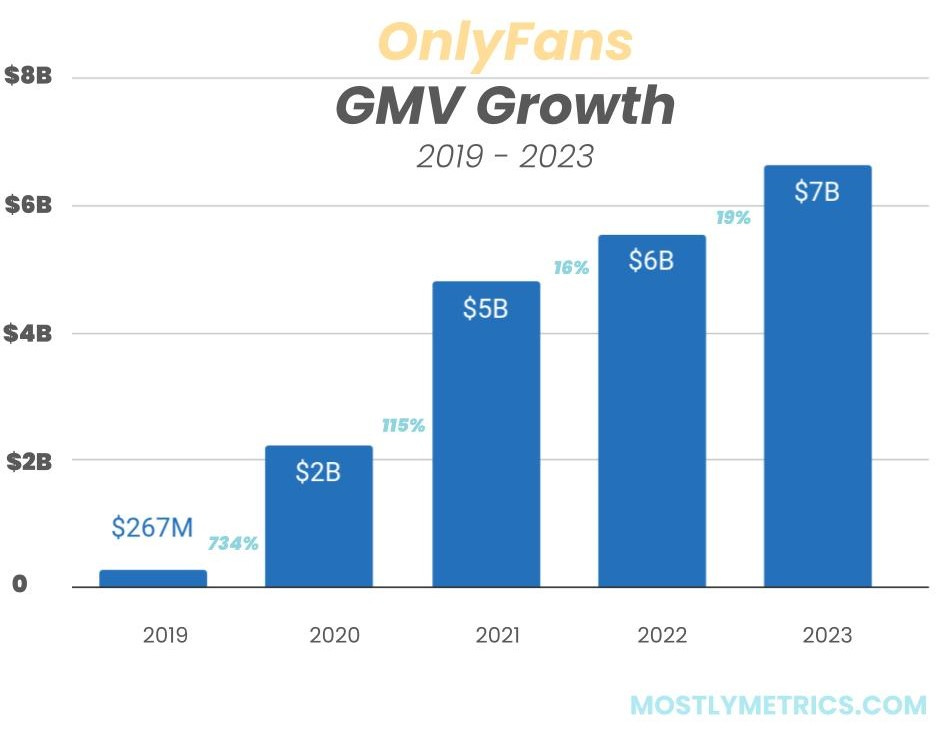

Gross Merchandise Value (GMV), representing the total payments made by users, grew from $5.6 billion to $6.6 billion, reflecting an 18% increase.

This growth was driven by an expanding user base and a significant rise in non-subscription revenue, which now makes up the largest share of income. Despite the impressive numbers, OnlyFans still faces challenges, including its heavy reliance on NSFW content, increasing competition, and potential risks related to payment processing infrastructure.

Fenix International Limited, the parent company of OnlyFans, operates the platform that has become synonymous with creator-driven, adult content. The business model is straightforward: OnlyFans provides a space for creators to directly monetize through subscriptions and one-time payments, taking a 20% commission on all creator earnings, including subscription fees, tips, and pay-per-view content.

OnlyFans’ mission is to be the safest social media platform, empowering creators to own their full potential. However, the company’s NSFW branding limits its ability to pursue mainstream opportunities like brand partnerships and content collaborations outside the adult industry.