Newsletter July 2024

Gain Insights and Strengthen Risk Management with CRiskCo’s New Financial Suppliers Tab!

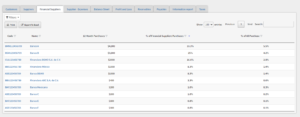

We’re thrilled to unveil our latest update! The “Financial Suppliers” tab is now available on the company reports page and in the SAT information report, offering detailed data on the top 10 financial suppliers, including names, RFCs, purchase amounts, and percentages within financial entities and all categories.

Know Your Competition and Past Financing Deals: Managing risk is crucial, and our new “Financial Suppliers” tab helps you do just that. It allows you to evaluate supplier concentration, identify key financial relationships, and gain insights into your client’s credit and payment history.

Enhance Risk Management with the New Geographic Distribution Feature

magine a hurricane forecasted to hit Quintana Roo. Do you know how this natural disaster could impact your applicants, clients, or suppliers in this region? Our new feature helps you gain these crucial insights quickly and effectively.

Proactive Risk Management

With our latest feature, you can visualize and list the geographic distribution of all clients and suppliers by state. Easily map out locations, identify regional risks, assess potential impacts, and take preventive action to manage risk. This tool helps you recognize dependencies in unstable regions, evaluate geographic impacts on your business, and make informed decisions to enhance risk management and ensure smooth operations.

Don’t miss out on this game-changing features. Log in now to explore them now!

New Insights: SMB Default Risks and the Power of AI in Financial Assessment

Did you know that 2-year-old startups face a 43.1% default risk, while businesses over 20 years old show just a 1.0% risk? AI is revolutionizing financial assessments by predicting default risks with greater precision, enhancing accuracy with advanced data analytics, and enabling smarter lending decisions. These insights help tailor strategies to mitigate risks based on business stages.

For more on how AI and data analytics are transforming financial assessments, read our full article by Erez Saf in Mexico Business News: Risk of SMB Defaults and the Power of AI

Empowering the Next Generation: CRiskCo CEO Erez Saf at TrepCamp

Erez Saf recently mentored young LATAM entrepreneurs in New York through the TrepCamp program, leading a class on “What is Successful Entrepreneurship and Who is a Successful Entrepreneur?“. His guidance not only inspired the next generation of startup founders but also showcased CRiskCo’s commitment to fostering innovation and entrepreneurship globally. By sharing his expertise, Erez is helping to shape the future of business, reinforcing CRiskCo’s role as a leader in the fintech industry.

Learn more about TrepCamp

Exciting Times in Mexico! 🇲🇽

We’re pleased to share that some of our team members recently traveled to Mexico to meet with our colleagues! In addition to having productive meetings and successful collaborations, they enjoyed delicious dinners and fun moments, strengthening our bonds and having a great time together.

Would you like to learn more about Open Finance?

Contact us